Will Relaxing En-Bloc Rules Really Improve the Prospects of Older Condos in Singapore?

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Ryan J. Ong

December 3, 2025

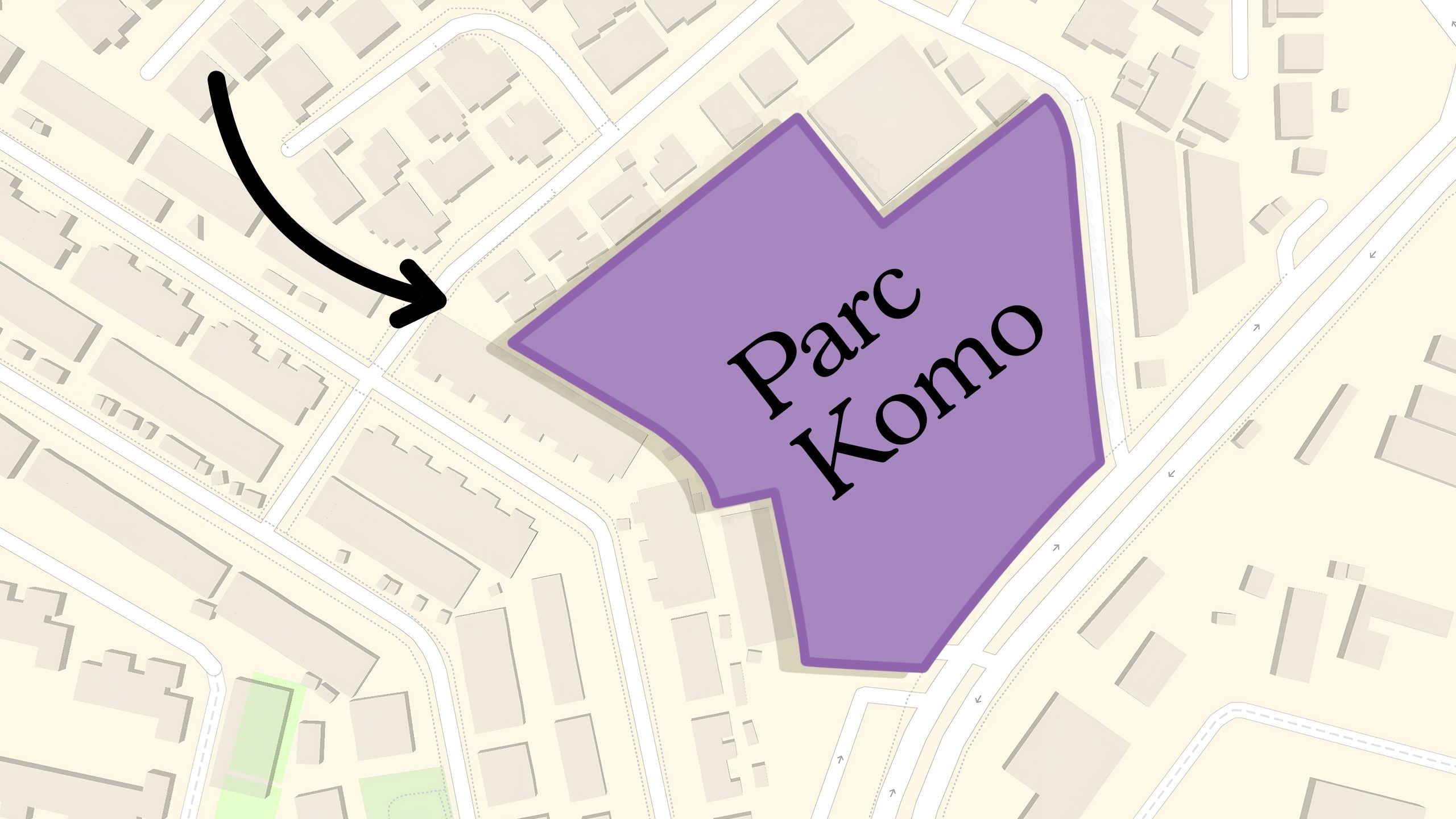

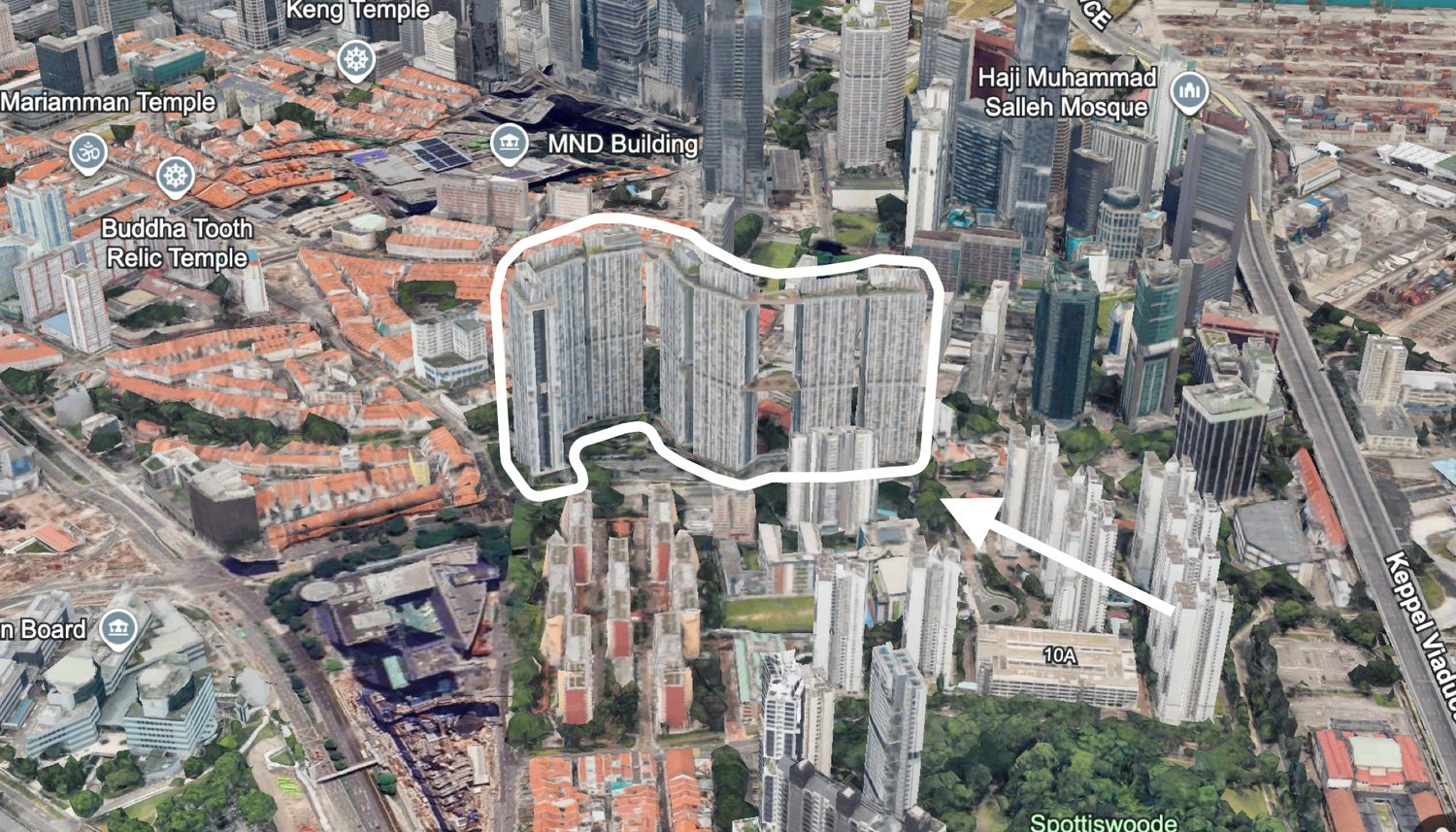

The en-bloc market has been slowing, helped along by a steady stream of GLS sites that give developers far less reason to chase older condos. So it’s not surprising that proposals are now circulating to make collective sales easier. As such, the Government is reviewing the en-bloc regime under the Land Titles (Strata) Act, with potential reforms on the horizon. But reviving a quiet market isn’t without trade-offs, especially in an ageing society where easier en-bloc rules could mean older homeowners being pushed to move. Here’s what’s happening:

And for many owners, the real question is what this means for their own estate: whether the odds of an en-bloc improve, and what the trade-offs might be if they do. If you’d like someone to walk through those scenarios with you, reach out here and we’ll connect you with a trusted partner agent who understands the mechanics.

What are some of the proposed changes?

While nothing’s confirmed yet, industry players (read: anyone who has a vested interest in reviving the en-bloc market) have proposed some of these changes:

- Lowering the majority-consent threshold. The most prominent idea is to lower the threshold to 70 per cent rather than 80 per cent. This would mean that owners of 70 per cent of the development’s share value and strata area (not 70 per cent of the total owners) need to consent for the en-bloc to go ahead.

- Tiered majority-consent thresholds based on the development’s age. In other words, the threshold gets even lower as the property gets older.

- Possibly rules around single large owners who block an entire sale. For example, a single owner of multiple units might hold 20 per cent or more of the share value, thus allowing them to single-handedly block a sale.

I notice, among all these suggestions, a claim that projects over 40 years old should have easier rules for collective sales, given high maintenance costs and lack of energy efficiency, as well as issues attracting tenants or buyers. Which must imply there’s something off about our building standards, since in plenty of other countries residential blocks have gone for 80, 100, 150+ years, etc., sometimes with less modern engineering.

Otherwise, it’s probably a strange coincidence how a committee of people suddenly decide the maintenance is too high to keep going, right around when the plot ratio has been enhanced.

In any case, it could be argued that what’s making en-bloc sales tougher isn’t simply the en-bloc rules

There’s been a slew of Government Land Sales (GLS) sites in recent years, and this is a bigger killer of en-bloc sales than any of the collective sale requirements. As of 2H 2025, the confirmed list has enough land to yield about 4,725 new units, and the total pipeline – if we include reserve list sites – would be about 9,200 units for 2025; and this was higher than last year, when supply was already at its highest point since around 2013.

As long as GLS sites are available, there’s less reason for developers to involve themselves with the messy, often unpredictable results of en-bloc sales.

The other issue, which might be an argument against making en-bloc sales easier, is the cost of replacement properties. If you receive sale proceeds of $1.8 million for your three-bedder condo in an en-bloc right now, well, that’s about a new launch two-bedder in 2025. You could go hunt for another resale three-bedder – but with so many others worried about the same replacement costs, your resale options will either be limited, or also painfully expensive.

More from Stacked

Why Do Property Agents Always Recommend New Launch Condos? Is It Really About The Money?

A common suspicion among buyers is that realtors will always push new launch properties on them, whether or not it’s…

That’s actually a good reason to rethink making en-bloc sales easier. For those who can’t handle the cost of a replacement property – especially older folks who face greater financing difficulties due to age – an involuntary en-bloc sale can be a disaster.

And on that note, Singapore is on its way to becoming a super-aged society. With more Singaporeans being too old to easily move or buy new properties, is this really a good time to try and perpetuate en-bloc sales?

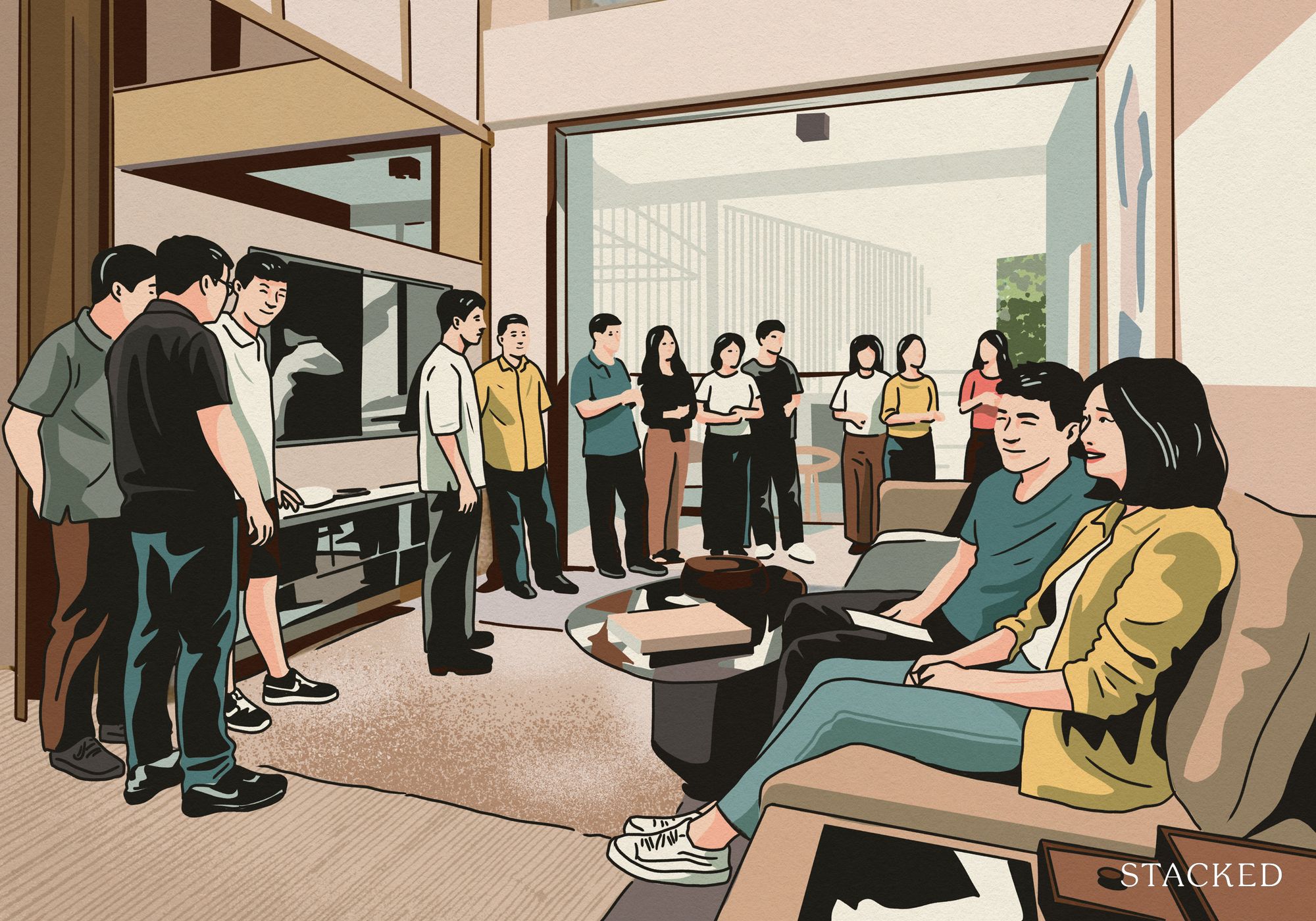

As a matter of opinion, the pro-sale committee for an en-bloc already has solid advantages

These arguably balance out the 80 per cent threshold needed. In most cases, the owners seeking the en-bloc organise with each other sooner; regular home owners don’t. No one is holding meetings to prepare a defence against a possible en-bloc, not until it actually happens.

So the homeowners who do want to stay can end up with less time and coordination to rally against the collective sale. Although, to the government’s credit, moves like limiting the number of proxy votes one can collect have helped this situation.

Another imbalance lies in the gap between owner-occupiers and investors. Most (not all) investors have an easier time with an en-bloc if they don’t live there. They have no issues with having to find or finance another property; possibly the most painful irritant for them is that, if they now want a second property after the en-bloc, they may have to deal with ABSD.

Some investors may even be speculators, who went in with the intent of benefitting from an en-bloc (in which case they made a bad decision considering how the market turned out, but that’s besides the point.) The pro-sale camp is likely to have more of these people, who aren’t only savvier but have the time and commitment to argue about the sale in the way a regular homeowner can’t.

This is a very human dimension: after an exhausting work week, most of us don’t want to burn a weekend arguing about all this; but for the dedicated property investors, that is their work.

This isn’t to say all en-bloc sales are somehow wrong

On a case-by-case basis, there are some decrepit properties that need to go en-bloc; and there are cases where the majority of owners will be in trouble if there isn’t an en-bloc (e.g., a leasehold property near expiry, where the owners can’t afford a replacement property if the value goes to zero.)

But perhaps these specific emergencies can be addressed as such, rather than with blanket rules making all collective sales easier.

The government might also consider exceptions to the Sellers Stamp Duty (SSD), which is imposed on unlucky buyers who may face an en-bloc too soon after buying their unit; they’d have to pay this even if they were against the en-bloc.

In any case, should the rules to ease en-bloc sales go through, it remains to be seen if it will make a substantive difference, given the higher supply of government land and the difficulties with replacement properties.

For more on the situation as it unfolds, follow us on Stacked.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News $281.2M in Singapore Shophouse Deals in 2H2025 — But That Number Doesn’t Tell the Full Story

Singapore Property News CapitaLand–UOL’s $1.5 Billion Hougang Central Bid May Put Future Prices Above $2,500 PSF

Singapore Property News Why New Condo Sales Fell 87% In November (And Why It’s Not a Red Flag)

Singapore Property News How Much Smaller Can Singapore Homes Get?

Latest Posts

Pro This 698-Unit Ang Mo Kio Condo Launched At The Wrong Time — And Still Outperformed Peers

Property Market Commentary 5 Key Features Buyers Should Expect in 2026 New Launch Condos

Editor's Pick What “Lucky” Singaporean Homebuyers Used To Get Away With — That You Can’t Today