Why This Freehold Mixed-Use Condo in the East Is Underperforming the Market

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Ryan J. Ong

December 4, 2025

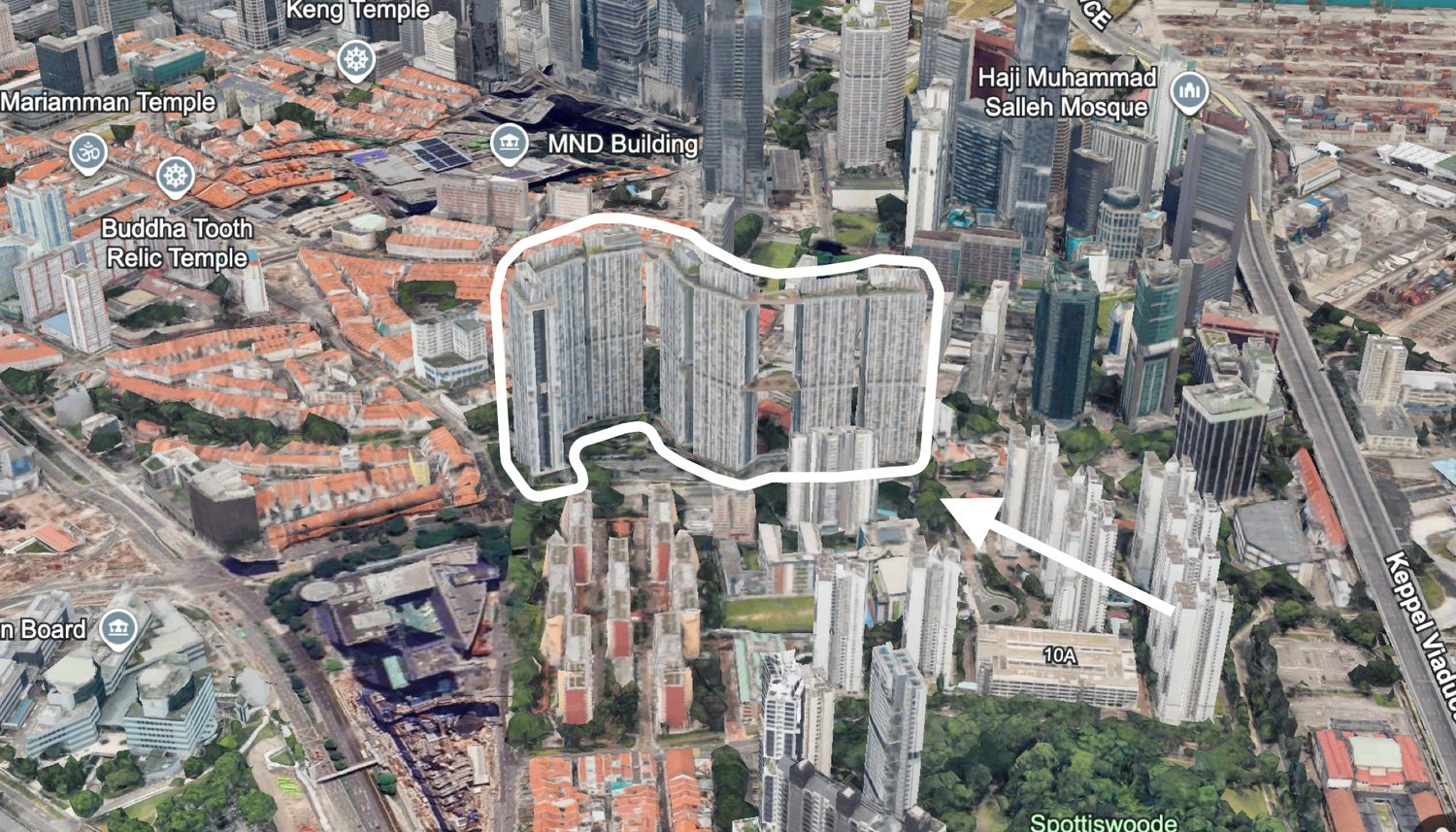

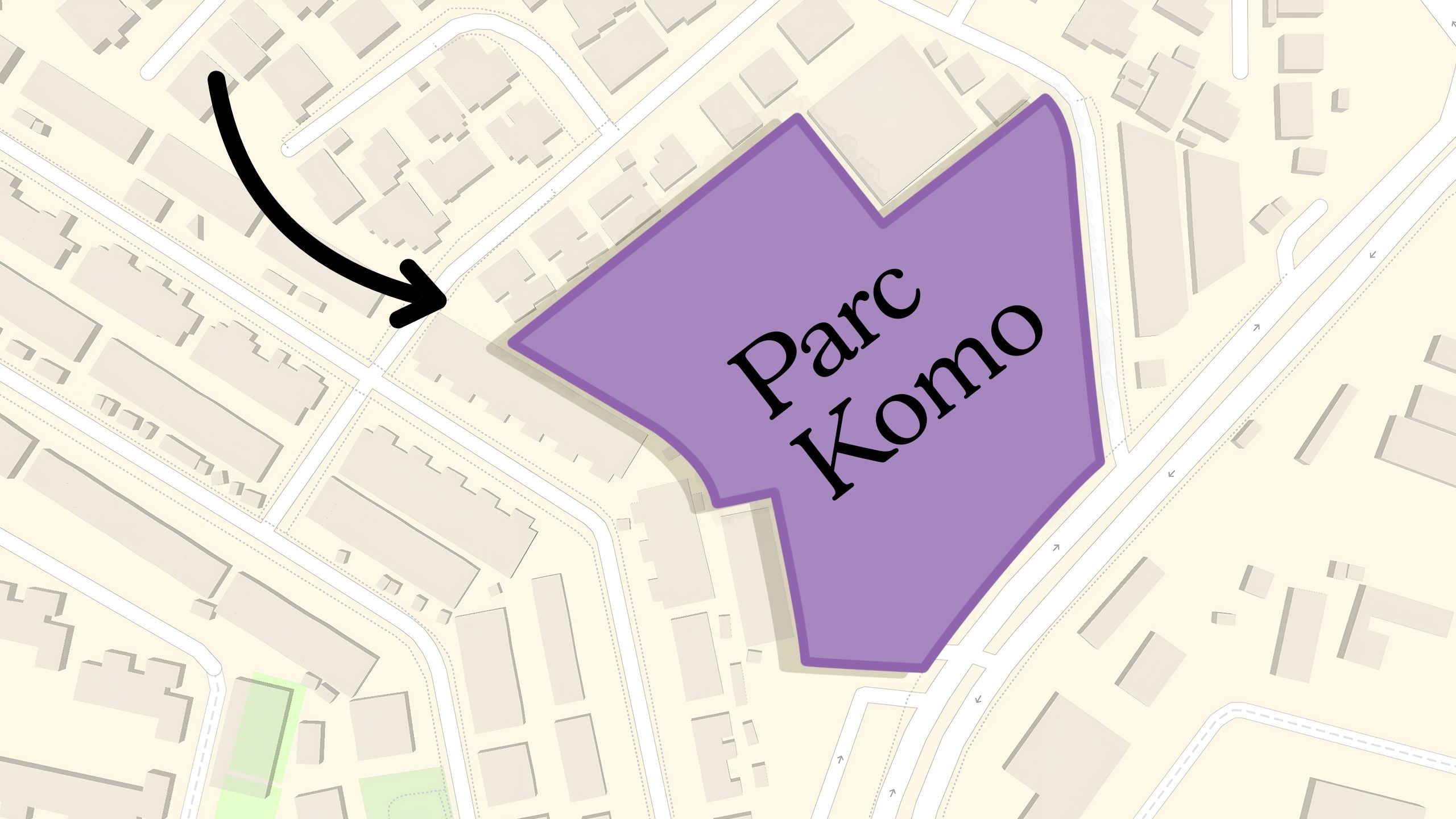

Parc Komo was one of the more under-the-radar launches of its day; at the time, it was marketed as one of the most competitively priced freehold projects in Singapore. More than that, Parc Komo was seen as the solution to a longstanding issue: it’s a mixed-use project that introduced key amenities, such as a supermarket and eateries, in an area that lacked such elements. Fast forward to today, however, and the performance of Parc Komo seems to be trailing. Here’s a deep dive into why that may be happening, and whether that may change:

And mixed-use developments don’t always follow the straightforward growth path buyers imagine, sometimes the surrounding area takes longer to mature than expected. If you’d like help understanding how these neighbourhood dynamics might affect your own plans, reach out here and we’ll link you with a trusted partner agent.

Let’s start with an overview of Parc Komo’s performance

| Year | Average $PSF |

| 2019 | $1,512 |

| 2020 | $1,497 |

| 2021 | $1,570 |

| 2022 | $1,650 |

| 2023 | $1,816 |

| 2024 | $1,754 |

| 2025 (Up to Q3) | $1,712 |

| Annualised | 2.09% |

For context, let’s compare this performance to other 999-year/freehold condos across Singapore (as Parc Komo is freehold), as well as to other 999-year/freehold condos in District 17 (D17).

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Investment Insights These Resale Condos In Singapore Were The Top Performers In 2025 — And Not All Were Obvious Winners

Property Investment Insights How A 944-Unit Mega-Condo In Pasir Ris Ended Up Beating The Market

Property Investment Insights What Changed In Singapore’s Property Market In 2025 — And Why It Matters

Property Investment Insights How Much More Should You Really Pay for a Higher Floor or Sea View Condo?

Latest Posts

Property Market Commentary 5 Key Features Buyers Should Expect in 2026 New Launch Condos

Editor's Pick What “Lucky” Singaporean Homebuyers Used To Get Away With — That You Can’t Today

Singapore Property News CapitaLand–UOL’s $1.5 Billion Hougang Central Bid May Put Future Prices Above $2,500 PSF