How This Singapore Property Investor Went From Just One Property to Investing in Warehouses and UK Student Housing

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Ryan J. Ong

November 24, 2025

For PL, real estate has always been a part of her investment portfolio. But for many years, “real estate” meant the usual options: buying physical property, holding listed REITs, and picking property stocks.

Over time though, she found these familiar options increasingly limited by high capital requirements and market cycles.

That search eventually led her to fractional real estate investing through RealVantage, an approach that opened the door to deals she could never have accessed on her own: a high-tech logistics warehouse in South Korea backed by e-commerce growth, or even a UK student accommodation development in Leeds.

We spoke to her about why she decided to approach property differently and how that decision has shaped her investments today.

“I already knew real estate was important. But I wanted something more balanced.”

“I’ve always believed that real estate is an important part of a diversified portfolio,” PL says. “Real estate has always been seen as lower-risk, with long-term returns and as a hedge against inflation,” she explains.

“It’s therefore an inalienable part of any portfolio. The challenge is that property is a big-ticket item. You need leverage, and you often don’t have the resources, expertise, or time to manage multiple properties.”

For years, her exposure was limited to her own home and the occasional listed property stock or REIT. It gave her stability, but never quite matched her dream of owning different types of properties across multiple countries:

“You’re either entirely hands-off with a REIT and you have no say in what the manager does, or you’re dealing with the full burden of owning property yourself,” she explains. “Neither is quite ideal.”

Over time, PL built a portfolio that reflected the flexibility she’d always wanted. “I want a diversified portfolio with properties across different geographies, asset types, and strategies,” she says. “My portfolio comprises a mix of opportunistic and core deals, with tenures ranging from a year to four. Some of my invested deals have an overall risk-adjusted return of above 10 per cent net IRR, while others afford me the opportunity to earn income along the way.”

That’s why she decided to try something different

What caught PL’s attention about fractional real estate investing was the middle ground it offered.

“The biggest appeal for me was how much choice it opened up,” she says. “You can invest in institutional-grade, overseas properties, choose between different risk levels and asset types, and spread your investments without putting all your capital into a single deal.”

It was also important to her that the process felt transparent and thoughtful. “The team’s discipline and risk management really came through in how they presented each opportunity. It wasn’t just about making deals look attractive; it was clear they’d done the work.”

PL’s professional background also gave her a sharper lens on investing.

Having worked in financial institutions spanning fund management, securities, and insurance, she developed a deep appreciation for data, diversification, and risk management. At the same time, her personal journey with yoga reshaped how she handled market volatility.

When she discovered fractional real estate investing, PL says, “What caught my eye was how it checks all the boxes: developed market exposure, diversification, a wide range of asset types, bite-sized entry points, and efficient structures. Most importantly, I could choose the specific projects that suited me, instead of being coerced into a pooled portfolio.”

More from Stacked

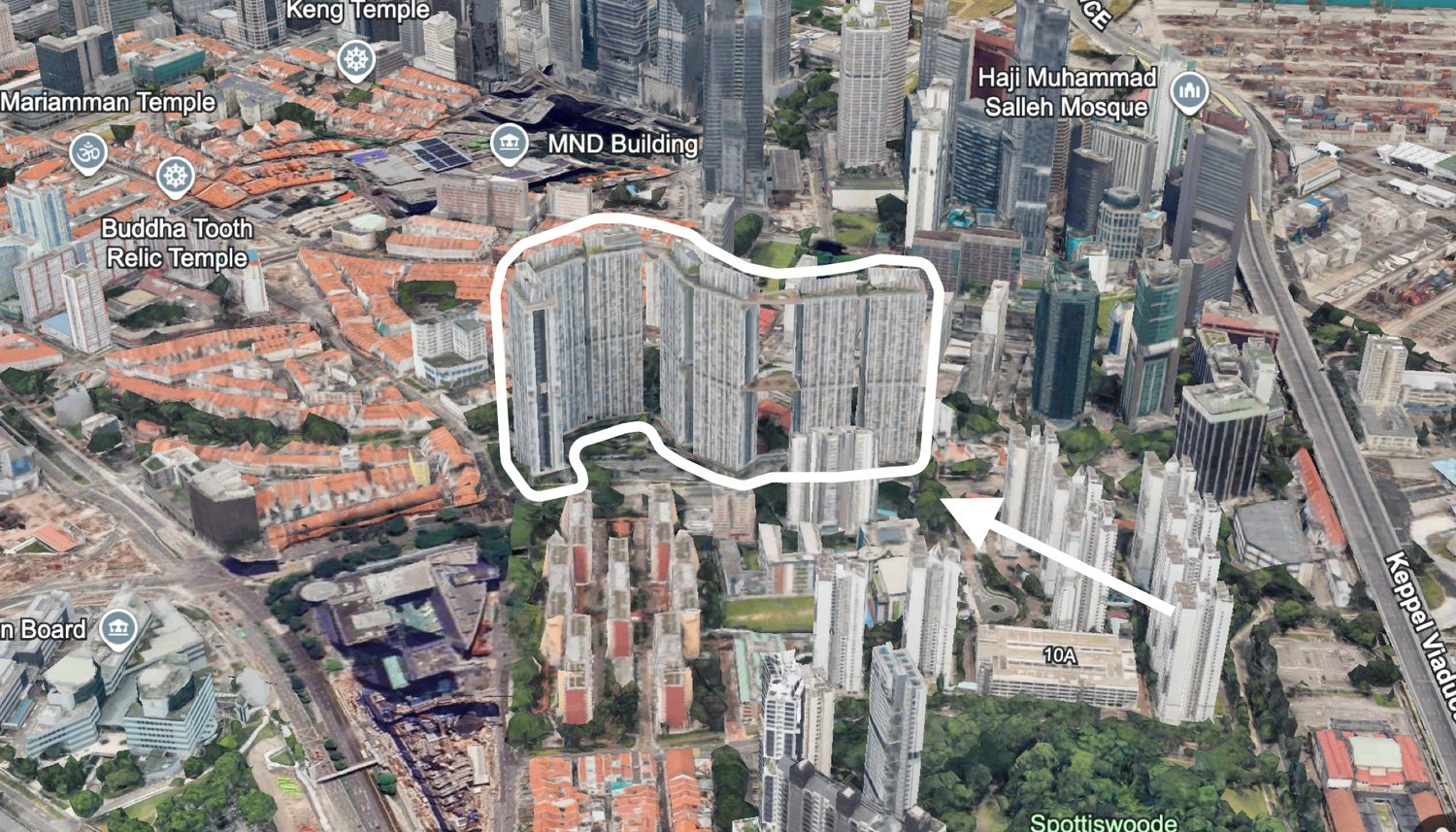

This 698-Unit Ang Mo Kio Condo Launched At The Wrong Time — And Still Outperformed Peers

When The Panorama, a 698-unit condominium on Ang Mo Kio Avenue 2, launched in 2014, it faced a fairly modest…

Among the projects she’s invested in through RealVantage are:

- A South Korea logistics investment, a 21-month high-tech warehouse project with a top-tier developer, targeting high-teen IRR and backed by strong demand from e-commerce growth.

- An Amsterdam data centre opportunity, RealVantage’s first foray into digital infrastructure, with most returns projected within the first four years of a 65-month tenor. “Project Nova stands out,” PL adds. “It’s exactly the type of deal I like but could never access on my own.”

- An Australian debt fund, offering steady distributions across a diversified, core portfolio of assets.

- A UK purpose-built student accommodation deal in Leeds, capitalising on supply shortages in the city with the largest student population in the UK.

Getting started and what it’s been like since

Like any new platform, there was a short adjustment period. “It did take me a little while to get used to the interface. But once you figure out where everything is, it’s very intuitive. Checking your investments, funding, and withdrawing, it’s all very straightforward now.”

Transparency was also something she noticed early on. “The level of reporting and updates has been excellent. For me, that’s really important because these are investments I’m making with my retirement in mind. I want to know what’s happening.”

PL now spreads her investments between steadier core projects and more opportunistic ones: “What I’ve achieved is balance – income and growth. I can pick deals that fit my goals, and I know I’m building something sustainable.”

Several of her early investments have already matured with outcomes she’s been happy with, which has encouraged her to reinvest and increase her allocation over time.

“When I first started with RealVantage, I invested mostly in opportunistic and value-add deals,” she says. “Subsequently, I ventured into core and core-plus deals to achieve a diversified portfolio with good risk-adjusted returns of above 10 per cent net IRR.”

What she’d tell others thinking about it

Looking back, PL says the only thing she’d change is having started sooner.

Her advice to someone just starting out is simple. “Don’t overthink it. Start small, get used to the platform, and build from there. Once you get comfortable, you’ll probably find yourself wanting to invest more.”

While she thinks most investors could benefit from this approach, she notes it’s especially useful for those who want global exposure and diversification without needing to commit a large lump sum or take on the work of managing a property.

What’s changed for her

Looking back, PL says the biggest change isn’t just in her portfolio; it’s in how she invests overall. “I now focus on finding good managers and letting them take away the hassle of investing while still giving me the returns I look for. That frees me up to spend more time on personal interests. It’s a virtuous cycle: more peace, more trust, more returns, and more holidays.”

Her advice to others is simple: start small, learn, and build comfort. “Fear and unfamiliarity hold people back. But once you understand the process, you’ll see that you can build a global real estate portfolio without the traditional headaches.”

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

Property Investment Insights This 698-Unit Ang Mo Kio Condo Launched At The Wrong Time — And Still Outperformed Peers

Property Market Commentary What “Lucky” Singaporean Homebuyers Used To Get Away With — That You Can’t Today

Property Investment Insights These Resale Condos In Singapore Were The Top Performers In 2025 — And Not All Were Obvious Winners

Property Investment Insights How A 944-Unit Mega-Condo In Pasir Ris Ended Up Beating The Market

Latest Posts

Singapore Property News $281.2M in Singapore Shophouse Deals in 2H2025 — But That Number Doesn’t Tell the Full Story

Property Market Commentary 5 Key Features Buyers Should Expect in 2026 New Launch Condos

Singapore Property News CapitaLand–UOL’s $1.5 Billion Hougang Central Bid May Put Future Prices Above $2,500 PSF