How Much Smaller Can Singapore Homes Get?

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Ryan J. Ong

December 14, 2025

How bad can the compact unit trend get? It’s all a matter of perspective. Singaporeans like to think we have it pretty bad – in recent years, three-bedders have been around 800 to 900 sq ft. (or even 700 sq ft), two-bedders at under 600 sq ft., and one-bedders at around 400 sq ft. And as for the dual-key versions, let’s just say I can see why they aren’t popular. These units are already small – with the dual-key subunit.

I suspect I can enjoy the unique experience of stretching my arms in the morning, and I’ll simultaneously be in my kitchen, bedroom, and adjoining study. But as bad as this may seem, we’re still nowhere close to the squeezed nature of Hong Kong, or possibly New York City. Here’s an example:

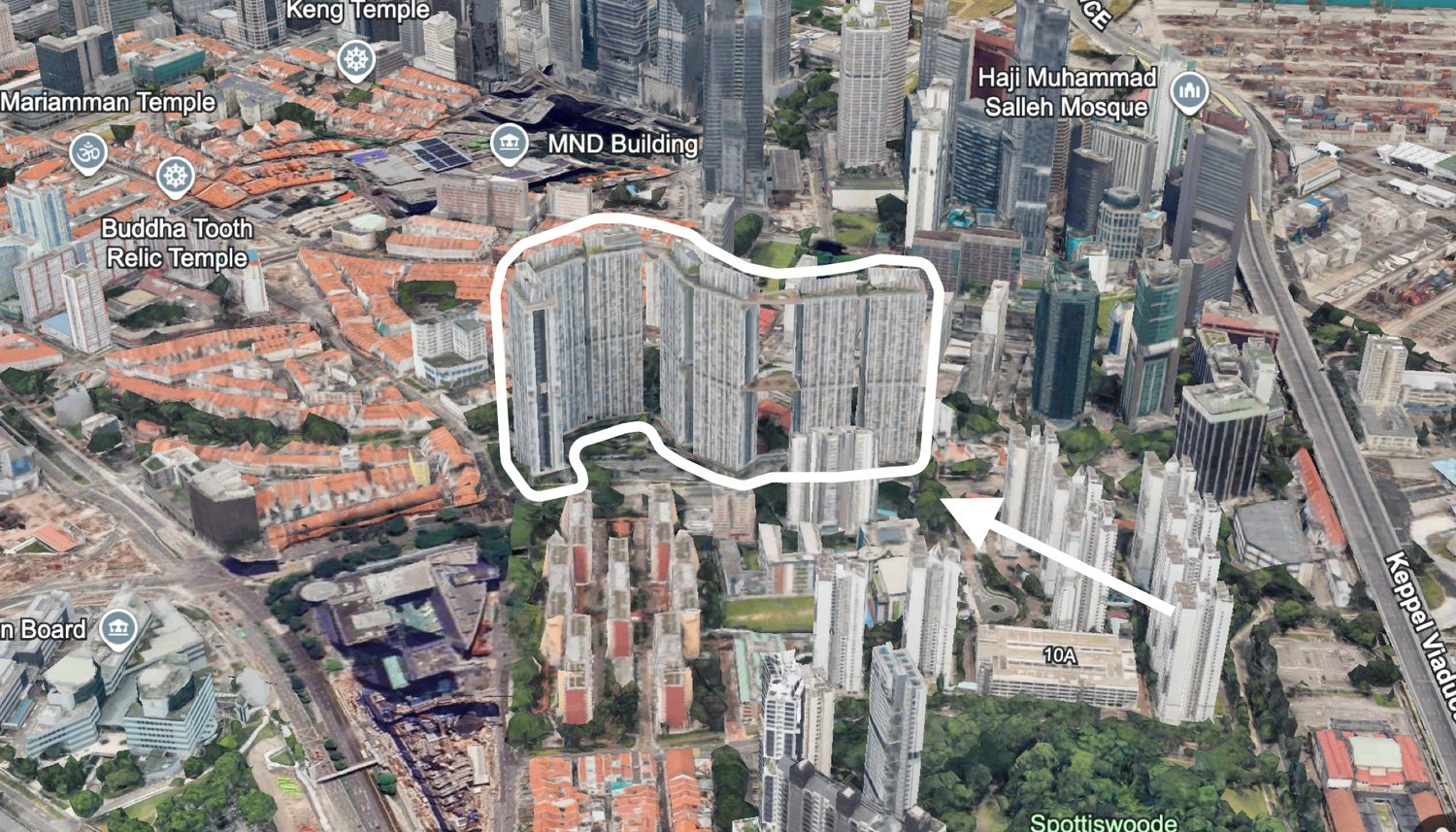

The three-bedder in that unit is 477 sq ft. That’s smaller than some one-bedders in Singapore. The two-bedder is 361 sq ft. For reference, a typical parking lot is 180 sq ft. Imagine two bedrooms, a bathroom, and a kitchen squeezed into a space that can hold maybe two Honda Civics. Space wise, I think that’s one microwave and a bunk bed away from calling it “micro-living”.

It isn’t just Hong Kong either, the proliferation of ever more compact units affects almost every major city struggling with housing prices (read: most of them since COVID.) In New York City, micro-units that measure around 300 sq ft. rent for US $1,900 to US$2,200 per month, making it affordable to middle-income singles and, I imagine, particularly stunted hamsters. I don’t know about the cost, but I do know this: if 300 sq ft. can be rented for that price, there’s going to be a rush of developers and landlords building and buying more of these as rental assets.

Developers have to work hard to convince us of the viability of smaller units; and if history proves anything, it’s that we will buy it

They won’t use the word small, ever. We’ll hear words like “thoughtful design”, “layout efficiency”, and “streamlined.” And because the show flat has good lighting, a ton of mirrors, and big open spaces knocked into the walls with see-through rooms, a surprising number will eat it up and say, “Wow, what a smart layout.”

This is how more people have already come to accept 600+ sq ft two-bedders as viable family homes. And if people in cities like Hong Kong are any sign, we can still adapt even further, to the point where layout efficiency = may not step on your roommate’s face when going to the toilet at night.

But URA has cracked down on this three times now

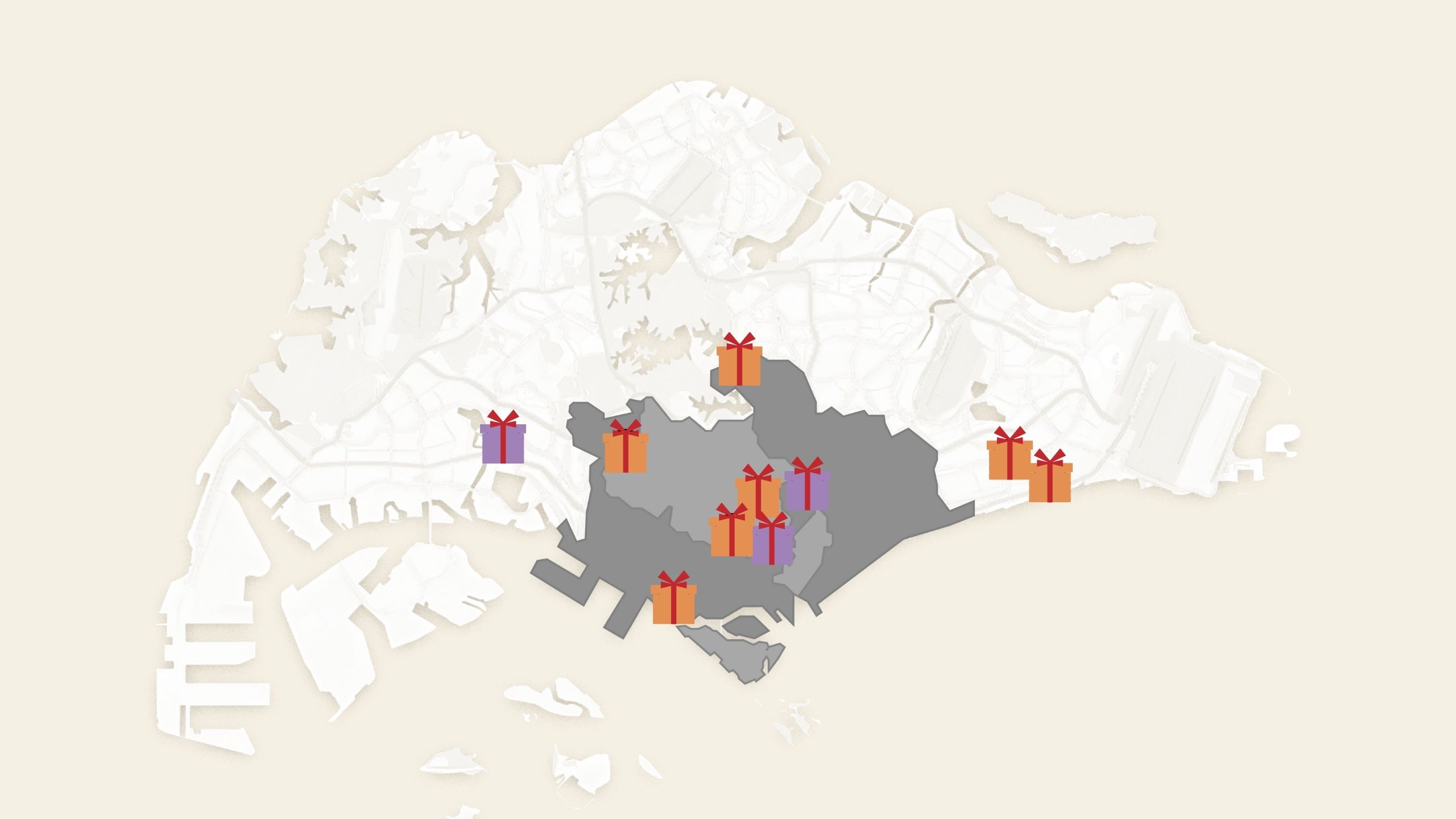

There’s a reason we never got to the same state as Hong Kong or parts of NYC. Here’s the quick reminder:

- In 2012, URA imposed an average unit size rule (70 sqm/753 sq ft).

- In 2018, URA tightened it further, even flagging projects like Margaret Ville and The Tapestry, where over half of the units were shoeboxes.

- In 2023, they slapped CCR condos with a new rule: at least 20 per cent of units must be family-sized (about 753 sqm).

Each time, the URA has made clear that they monitor residential property trends closely, and “will adjust the guidelines if needed.”

More from Stacked

What DIY Property Buyers In Singapore Might Miss Out On (And Why It Matters)

Some home buyers have the idea that, if they skip the buyer’s agent, they’ll save money or have an easier…

But consider that the current trend is to build smaller and more affordable; a tactic now accepted by the market, as we saw with launches like River Green. If developers really take this as a sign that they can go even smaller, then it’s just a matter of time before we see that happening as land prices go up.

So far, URA hasn’t outright stopped the building of compact units, merely prescribed minimum size averages, or percentage allocations of smaller units. But given how eager they are to turn CCR zones into viable family living areas, it wouldn’t surprise me if there were measures taken in prime areas; possibly even developer incentives tied to family-oriented homes (e.g., more leeway on the five-year ABSD time limit, for projects that build only three-bedders or larger).

This isn’t entirely without drawbacks, though. If the brakes slam down on compact units, it might close off doors to home ownership for some singles, and it may be an even more uphill struggle for sandwiched Singaporeans, who bust the HDB income ceiling but also can’t afford a true family-sized condo unit.

Meanwhile in other property news:

- What happens when a PR might be forced to look for private housing, after her Singaporean citizen spouse passes on? We discussed the situation and some possible solutions.

- If you’re a young (especially single) Singaporean and feel it’s exceedingly hard to be a homeowner today, we have bad news and worse news: you’re not wrong, and it’s not likely to get better.

- Costa Cabana can frankly sell just on the basis of being an EC in the East, but here’s a review of this upcoming new project.

Follow us on Stacked for news and updates on the Singapore property market.

Weekly Sales Roundup (1 to 7 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

|---|---|---|---|---|

| THE RESERVE RESIDENCES | $6,717,720 | 2530 | $2,656 | 99 yrs (2021) |

| UNION SQUARE RESIDENCES | $5,234,000 | 1518 | $3,449 | 99 yrs (2024) |

| PINETREE HILL | $4,687,000 | 1733 | $2,705 | 99 yrs (2022) |

| GRAND DUNMAN | $4,422,000 | 1927 | $2,295 | 99 yrs (2022) |

| THE CONTINUUM | $3,950,000 | 1496 | $2,640 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

|---|---|---|---|---|

| THE CONTINUUM | $1,338,000 | 560 | $2,390 | FH |

| TEMBUSU GRAND | $1,426,000 | 527 | $2,704 | 99 yrs (2022) |

| OTTO PLACE | $1,486,000 | 872 | $1,704 | 99 yrs (2024) |

| ZYON GRAND | $1,513,000 | 538 | $2,811 | 99 yrs (2024) |

| AURELLE OF TAMPINES | $1,515,000 | 840 | $1,804 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

|---|---|---|---|---|

| TURQUOISE | $12,000,000 | 7987 | $1,502 | 99 yrs (2007) |

| BALMORAL RESIDENCES | $6,399,000 | 2314 | $2,765 | FH |

| LEONIE TOWERS | $6,250,000 | 3251 | $1,923 | FH |

| THE RESIDENCES AT W SINGAPORE SENTOSA COVE | $6,081,200 | 3272 | $1,858 | 99 yrs (2006) |

| THE BALMORAL | $5,300,000 | 2680 | $1,977 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

|---|---|---|---|---|

| SUITES AT BUKIT TIMAH | $688,000 | 366 | $1,880 | FH |

| MY MANHATTAN | $720,000 | 441 | $1,631 | 99 yrs (2010) |

| #1 SUITES | $730,000 | 560 | $1,304 | FH |

| CARDIFF RESIDENCE | $735,888 | 420 | $1,753 | 99 yrs (2011) |

| PARC ELEGANCE | $753,000 | 441 | $1,706 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | GAINS ($) | HOLDING PERIOD |

|---|---|---|---|---|---|

| LEONIE TOWERS | $6,250,000 | 3251 | $1,923 | $3,600,000 | 20 Years |

| PARK INFINIA AT WEE NAM | $3,620,000 | 1442 | $2,510 | $2,389,000 | 19 Years |

| BALMORAL RESIDENCES | $6,399,000 | 2314 | $2,765 | $2,299,000 | 15 Years |

| SOMMERVILLE PARK | $4,390,000 | 1959 | $2,241 | $2,010,000 | 19 Years |

| ST MARTIN RESIDENCE | $3,880,000 | 1528 | $2,538 | $1,880,000 | 25 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | LOSS ($) | HOLDING PERIOD |

|---|---|---|---|---|---|

| MARINA ONE RESIDENCES | $1,342,000 | 743 | $1,807 | -$317,398 | 6 Years |

| GILSTEAD TWO | $1,600,000 | 904 | $1,770 | -$78,483 | 15 Years |

| SOPHIA HILLS | $1,058,000 | 570 | $1,855 | -$76,000 | 9 Years |

| SPOTTISWOODE SUITES | $1,080,000 | 452 | $2,389 | -$57,000 | 13 Years |

| NORMANTON PARK | $930,000 | 527 | $1,763 | -$36,000 | 4 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

|---|---|---|---|---|---|

| NEPTUNE COURT | $1,400,000 | 1270 | $1,102 | 268% | 23 Years |

| BISHAN 8 | $2,300,000 | 1163 | $1,978 | 241% | 20 Years |

| FAR HORIZON GARDENS | $2,200,000 | 1948 | $1,129 | 238% | 25 Years |

| THE CENTRIS | $1,530,000 | 936 | $1,634 | 222% | 19 Years |

| THE JADE | $1,950,000 | 1335 | $1,461 | 210% | 21 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

|---|---|---|---|---|---|

| MARINA ONE RESIDENCES | $1,342,000 | 743 | $1,807 | -19.1% | 6 Years |

| SOPHIA HILLS | $1,058,000 | 570 | $1,855 | -6.7% | 9 Years |

| SPOTTISWOODE SUITES | $1,080,000 | 452 | $2,389 | -5.0% | 13 Years |

| GILSTEAD TWO | $1,600,000 | 904 | $1,770 | -4.7% | 15 Years |

| THE GLADES | $835,000 | 484 | $1,724 | -3.8% | 8 Years |

Transaction Breakdown

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News CapitaLand–UOL’s $1.5 Billion Hougang Central Bid May Put Future Prices Above $2,500 PSF

Singapore Property News Why New Condo Sales Fell 87% In November (And Why It’s Not a Red Flag)

Singapore Property News The Hidden Costs of Smaller Homes in Singapore

Singapore Property News 10 New Upcoming Housing Sites Set for 2026 That Homebuyers Should Keep an Eye On

Latest Posts

Property Market Commentary 5 Key Features Buyers Should Expect in 2026 New Launch Condos

Editor's Pick What “Lucky” Singaporean Homebuyers Used To Get Away With — That You Can’t Today

Property Investment Insights These Resale Condos In Singapore Were The Top Performers In 2025 — And Not All Were Obvious Winners