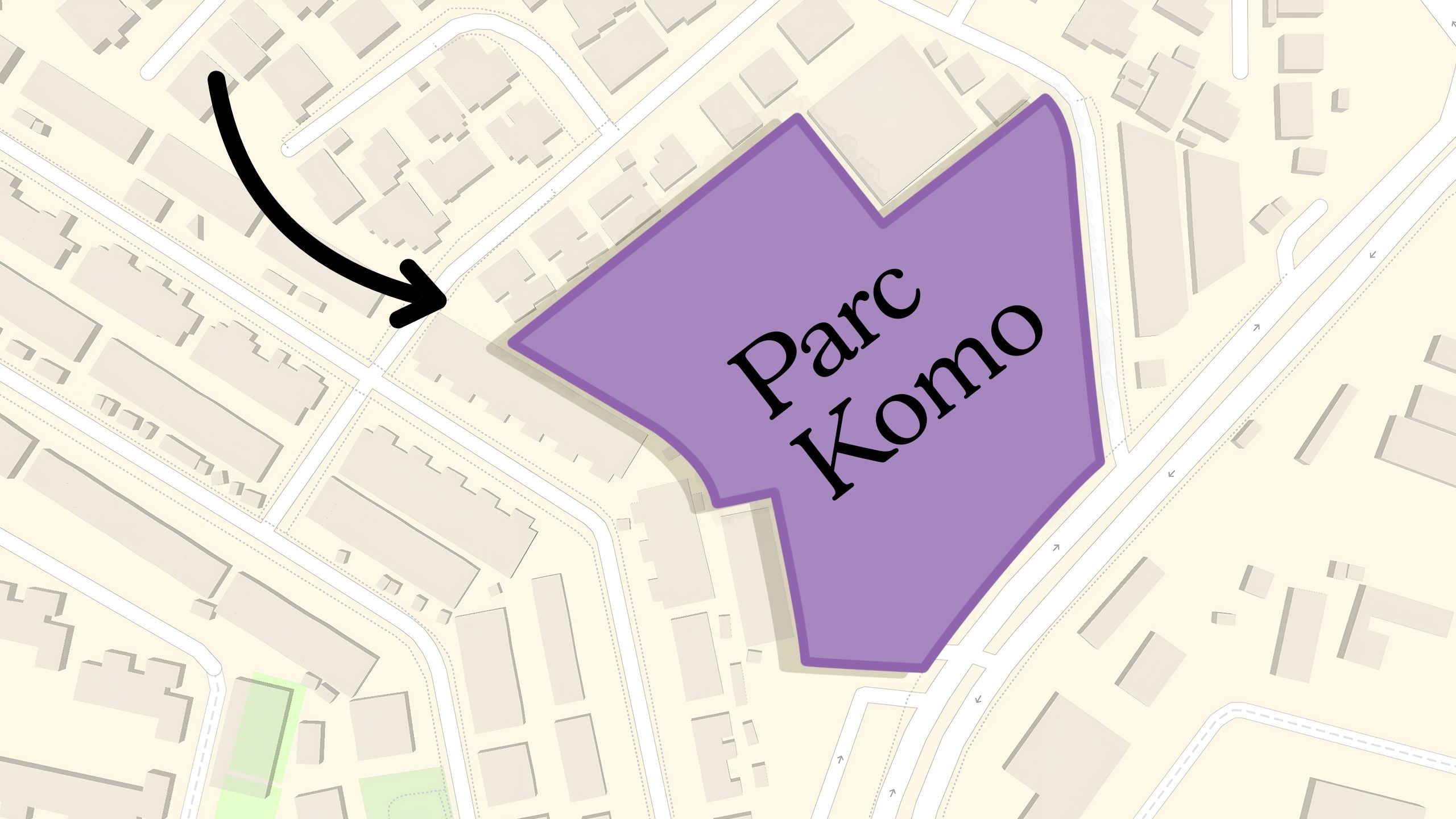

Old vs New Family-Sized Condos in District 9: A Data-Driven Analysis of Value in 2025

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

I know this info is not easy to get, but for these properties, it is not really fair to compare rental yields without taking maintenance & sinking fund fees into account because you could be talking $500/mth compared to $1500-2000/mth.

Hey Siew Wei Ngiam, you’re absolutely right — maintenance fees and sinking funds can make a meaningful difference to actual rental yields, and it’s not always fair to compare without factoring them in.

Property is nuanced in so many ways: things like renovations, layouts, facilities, and even how well a condo is maintained can all affect returns.

In this piece, we looked at the numbers in aggregate to spot broader systemic patterns that might be useful as a starting point. That said, we take feedback like yours seriously, and when we have the resources, we’ll definitely aim to dive deeper into individual developments to account for things like maintenance and sinking funds.

Thanks for raising this — it’s an important reminder of the complexity behind the numbers!